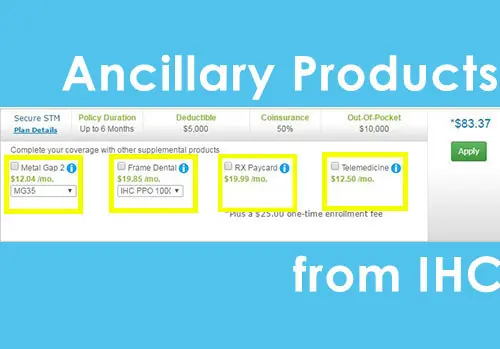

Ancillary Products from IHC

IHC has been known for Short-Term Medical insurance, to protect your clients between Obamacare plans.

But, did you know how easy it can be to add their ancillary plans?

IHC helps clients fully round out their coverage, saving them from crippling gaps that can save thousands in exposure.

These are available from the IHC Marketplace. Here’s an example of how easy it is to cross-sell a client by adding Ancillary Insurance Products.

- Metal Gap gives you a bundle of Accident Medical Expense, Critical Illness, and Hospital Confinement, all in one package, with no medical underwriting.

- Frame Dental is one of the best known and trusted dental networks, offering three different plans.

- RX Paycard allows your client to purchase hundreds of prescription drugs with a simple, easy to understand, copay at participating pharmacies.

- Telemedicine provides a telephone and video consultation that is low cost and convenient for the consumer. This is from a licensed, board-certified physician and available 24 hours a day, 7 days per week.

Bottom Line

Even those with Obamacare health insurance usually need more coverage than they get with the policy. People need dental and vision care. Research shows that vision and dental plans help prevent more serious problems for those who have the extra coverage. It also lowers medical claims. Also, health insurance provides nothing in a fatality situation. Life insurance, final expense, covers the unexpected expenses involved with the death of a loved one. Health insurance does not provide income protection for the surviving spouse and family. Life insurance does. For life insurance claims, the beneficiary is paid directly. Also, with the addition of Long-Term Care, Critical Illness, Hospital Indemnity, Cancer Heart & Stroke insurance there are many niche protection plans to really help people for a very low cost. Ancillary plans are usually a non-medical testing situation too. How fast can you be covered? Nearly as fast as it takes to take the e-app and submit it. Ancillary plan carriers normally have the best production tools in the market. Most likely this is because these plans are not overly regulated by the government, with lengthy compliance procedures and long lists of things that take up a great deal of time and money. Ancillary carriers can focus on making their products the best they can be, the easiest and fastest to produce, claim turn times, quality information and more. Ancillary products can also be added to an employee benefit situation, as voluntary or employer-contributed premiums. It can make the difference between offering employees middle-of-the-road or excellent benefits.

The big key is to know what works best, for which situation, and who has the best price for coverage.

That’s where Empower can help. We have Group and Ancillary experts, who would love to help you ramp up your career in Ancillary benefits.

Contact us to request personal assistance and let’s make it happen!