Understanding State Application Requirements from Mutual Trust

In today’s remote world and with documents being handled online, it is easy to lose sight of state-specific requirements regarding policy owner application signatures and policy delivery. Mutual Trust Life Insurance Company shares the following tips on State Requirements during the application process.

When determining state-specific signature requirements, the key is the state where the policy owner is physically present.

- You must be licensed and appointed in the state in which the application is completed and signed. In addition, you must be licensed and appointed in the state in which the policy is delivered to the policy owner.

- The forms used to execute the application must be approved in the state in which the policy owner signs the application form.

- The policy must be delivered to the policy owner in the same state in which they signed the application.

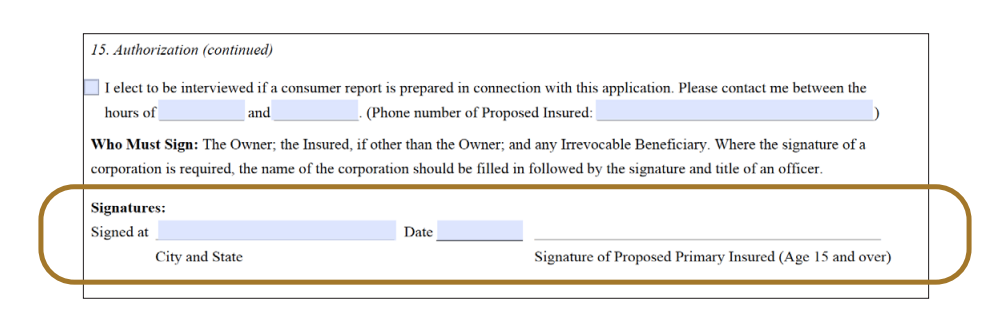

- The city and state of signatures are requested in the Authorization section of the application. (See diagram below.) Before submitting the form, this information must be completed and needs to reflect the city and state where the policy owner signed or, in the case of the Remote Signature Process (DocuSign), will sign the form.

- Note that if a form requests the signature of an applicant, the owner must sign. If there are multiple owners, all owners must sign.

To assist you in complying with these requirements, agents must select the appropriate state-specific application package from the Mutual Trust Agent Website that applies in the state where the forms will be signed. Failure to comply with these requirements can subject you to regulatory disciplinary action including fines and penalties. Mutual Trust Life Insurance Company expects strict adherence to these rules.

About Mutual Trust Life Insurance

Founded in 1904, Mutual Trust Life Insurance Company develops, underwrites, and services individual life insurance and annuities in 49 states and the District of Columbia. As a mutual insurer, the company has no shareholders, but rather it exists for the benefit of its policy holders. Today, Mutual Trust is a wholly owned subsidiary of Pan American Life Insurance Group (PALIG), which is a leading provider of insurance and financial services throughout the Americas. It continues to operate within a mutual holding company structure, so while dividends are not guaranteed nor required by law, their financial strength and sound management has enabled them to pay policy owners for more than 100 years. Mutual Trust is headquartered in Oak Brook, Illinois and maintains an “A” (Excellent) rating from A.M. Best.

We hope this information on Understanding State Application Requirements from Mutual Trust Life is helpful to you. Give us a call if you have any questions or would like to get appointed with Mutual Trust Life Insurance Company. 1-888-539-1633.

Quick Links:

• Contracting Portal

• Check out Events

• Get Customized Marketing Materials